CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Founded in 2002, XTB is a well-known CFD broker that is based in London and Warsaw. Several regulators across the world oversee XTB’s operations, including the tier-1 UK Financial Conduct Authority (FCA). XTB publishes its financial records in a transparent manner, which is always a plus when it comes to online brokers.

XTB has gained traction in the highly competitive industry, and now offers access to a good range of markets, including FX, stocks, metals, commodities, indices, and cryptocurrencies.

Could this CFD broker possibly be the one you’ve been looking for? If you’re looking for an in-depth answer to this question, you’ve come to the right place.

Disclaimer: CFDs are highly complex instruments that carry a high risk of losing your money quickly due to their leverage. When trading CFDs with this supplier, 73 percent of retail investor accounts lose funds. You’re recommended to think about whether you really understand how CFDs work and whether you are ready to take the risk of losing your money.

Summary

XTB is a good option for traders who wish to cut their costs as much as possible, whether it's the cost of placing a trade or not having to pay extra fees like wire fees. Non-U.K. traders can get up to 500:1 leverage, whereas UK-based traders can acquire up to 30:1 leverage. xStation 5, XTB's main platform, is an innovative, web-based offering. XTB's whole online offering to the clients consists of this, as well as the downloadable MT4 platform and a user-friendly mobile app. The broker prioritizes customer service and provides great educational materials and research resources, which would be beneficial to new traders.

However, it’s not available for US-based clients and its non-FX spread costs are rather high. Moreover, it has a modest range of offerings compared to other strong competitors.

Overview

Here is a quick overview of XTB basic information:

| Broker | XTB |

|---|---|

| Founded | 2002 |

| Headquarters | Warsaw, Poland |

| Minimum Deposit | $0 |

| Withdrawal Fees | Varies |

| Inactivity Fees | €10 after one year of inactivity |

| Demo Account | Yes |

| Forex Trading | Yes |

| CFD Trading | Yes (1500+) |

| Cryptocurrency | Yes |

| Copy Trading/Social Trading | No |

| Regulation | FCA,CySEC,IFSC |

| Mobile App | Yes |

| Customer Support | Phone, live chat and email |

| US-Accepted | No |

| Our Score | 4.7/5 |

Pros and Cons

XTB is a CFD broker, regulated by top-tier authorities. Below we list the pros and cons:

| Pros | Cons |

|---|---|

| ETFs/free stocks up to €100k monthly volume | Monthly inactivity fee |

| Regulated by tier-1 FCA | High stock CFD fees |

| The majority of withdrawals via bank transfers are fee-free | Few minor account currencies that are accepted |

| Listed On Stock Exchange | Non-FX spread costs are high |

| Mostly fee-free deposits | No two-step login |

| Low fees for forex and stock index CFD | The broker doesn’t hold a banking license |

| Fast and fully digital account opening process | Limited fundamental data |

| Demo Account | No guaranteed stop loss |

| No account minimum | No 24/7 customer support |

| Transparent fee report | Doesn’t accept US-based clients |

| Negative balance protection | No automated trading capabilities or back-testing |

| User-friendly platform | |

| Price alerts in the mobile app | |

| Charting tools | |

| Good-quality news flow | |

| Phone and live chat support | |

| Responsive customer support | |

| Great educational material |

XTB Compared

One of the best ways to decide whether a certain broker is good enough or not is by comparing it to its biggest competitors, which is exactly what we’re doing in the following table:

| Broker | XTB | Trading 212 | eToro | Degiro | Plus500 | Oanda | IG |

|---|---|---|---|---|---|---|---|

| Founded | 2002 | 2004 | 2006 | 2008 | 2008 | 1955 | 1974 |

| Minimum Deposit | $0 | $1 | $50 - $200 | $0 | $100 | $100 | $300 |

| Inactivity Fees | €10 after one year of inactivity | $0 | $10/month after 1 year | $0 | $10/month | $14/month | $18 per month after 24 months of inactivity |

| US-Accepted | No | No | Yes | No | No | Yes | Yes |

Account Opening Process

The account opening process at XTB is completely digital. It takes about 30 minutes to complete all of the forms and submit all of the paperwork. Your account should be verified within a day after you've finished. The steps to creating an XTB account are as follows:

- Write your country of residence and email address.

- Enter some personal information, such as your address and your date of birth.

- Choose the trading platform and the base currency for the account.

- You’ll be asked to answer some questions about your financial status, employment status, and trading experience.

- Verifying your residency and identity.

If you’re based in one of certain countries in Europe, you can use video chat to verify your identity. You must upload a picture or scanned copy of your ID, driver's license, or passport if video verification is not an option

Products

XTB gives you access to a good selection of assets:

- 1,500+ global stock CFDs

- 49 currency pairs

- 20+ global indexes

- 60 ETF and cryptocurrency CFDs

- Major commodities

CFDs and trading the underlying asset are both options for trading cryptocurrency. Note that no cryptocurrency CFDs are accessible via any UK entity of XTB, nor are they available to UK residents.

Commissions & Fees

XTB's pricing is comparable to the industry standard. First of all, there are 2 account types on XTB: the first one is the Standard account (spread-only), and the second one is the Pro account, which is commission-based.

As of August 2020, XTB sets target spreads for its different account types on the USD/EUR, 0.949 pips for Standard accounts and 0.349 pips for Pro accounts. Average spreads were a bit better during the main session at 0.859 for Standard accounts and 0.259 for Pro accounts throughout the same time period. XTB’s average USD/EUR spreads were 0.086 in Q2 2020, while the Pro account spread was approximately 0.03.

When trading high volumes, the Pro account is similarly priced to the Standard account at XTB, with minimum deposits starting at 250 base currency. For example, $250, £250, or €250. Meanwhile, the Standard account appears to be less expensive for modest amounts, which is best for retail traders.

XTB rebates back a portion of the spread (minimum of 5% and maximum of 30%) to active traders as well as traders in the EU who fulfil the description as elective professionals when they exceed specified volume thresholds, ranging from 20-1000 lots per month for the maximum 30% discount.

Non-trading fees at XTB are on the average side. There are no account fees, no deposit fees for bank transfers, and no withdrawal fees for bank transfers over a specific amount (from $50-$200 depending on the country of residence).

The fees for using a debit/credit card or an e-wallet to make a deposit vary depending on where you live. Typically, a fee of up to 2 percent is charged for these transfers. Debit/credit card transfers are totally free for UK-based traders, whereas USD transfers using e-wallets result in a 2 percent fee.

Finally, XTB charges its clients a monthly fee of €10 after one year of inactivity.

Deposit

For bank transfers, XTB does not charge deposit fees. Depositing with debit/credit cards and e-wallets may come with a fee, which ranges from 1% to 2% depending on where you live. PayPal and Skrill, for example, charge 2 percent of the amount deposited for UK-based clients.

Many e-wallets, in addition to debit/credit cards and bank transfers, are accepted for deposits:

- PayPal

- Skrill

- Neteller

- PayU

- Paysafe

- Paydoo

- Sofort

- ECOMMPAY

- SafetyPay

- Blik

- BlueCash

Payment with e-wallets and credit/debit cards is instant. However, bank transfers can take several days. You can only make deposits from accounts that are registered in your name. Note that the location in which you live decides the available e-wallets for you.

Withdrawal

If the amount you withdraw is more than a specific threshold, XTB will not charge you any withdrawal fees. You can only withdraw your funds through bank transfer, but not e-wallets or debit/credit cards.

It should take one business day for you to withdraw money from XTB. Your withdrawal can arrive on the same day if you initiate it before 1 p.m.

To make a withdrawal on XTB, Log into your account. Select ‘Deposit and withdraw funds' on the bottom right, write your bank account details then the amount of funds you want to withdraw. Finally, initiate the withdrawal.

Platforms

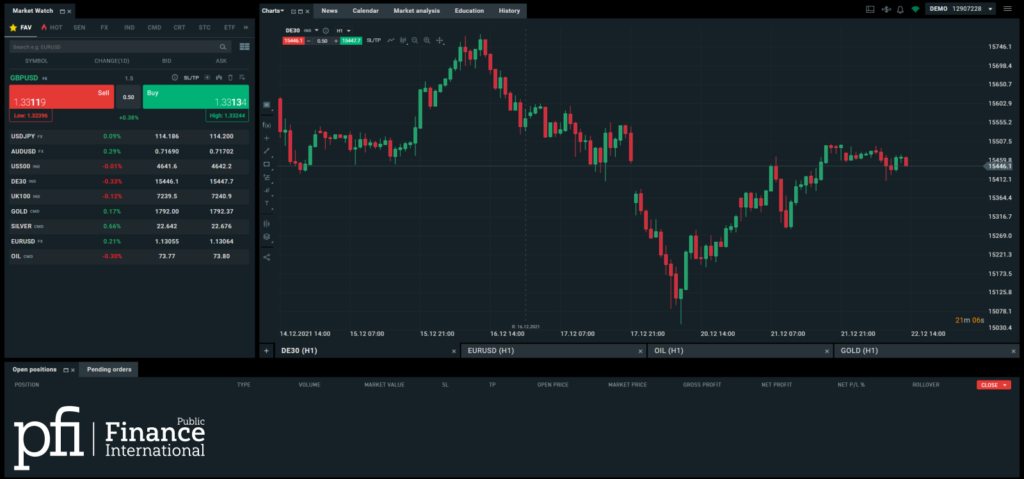

XTB has two platforms to choose from: xStation 5 and MetaTrader 4.

xStation 5 stands out thanks to various unique features in addition to its advanced design. For example, there are these charts that have a countdown timer showing how much time is left in each candlestick. Economic news releases, for example, display on the bottom axis of charts and provide traders with information during major economic events. There are a total 37 technical indicators and 29 drawing tools to choose from.

The xStation 5 platform has a simple look but is packed with sophisticated tools and provides a user-friendly experience on the web, tablet, mobile, and smartwatches for Android and iOS. Sentiment analysis and heat mapping, a sophisticated stock screener, are among the trading tools that stand out.

Custom baskets can hold both short and long positions, making them ideal for more advanced trading strategies. The “investment basket” option in xStation 5 is an absolute game changer, allowing you to design a thematic basket of multiple symbols and then make one order to execute all of them in one go.

Aside from automated trading, xStation 5 is XTB's preferred platform because MT4 is somewhat more expensive due to high spreads, and there is no MT5 available.

Mobile App

XTB's xStation 5 mobile app is significantly better than their MetaTrader 4 (MT4), we can confidently say that XTB's mobile app is in line with the leading forex brokers. The xStation app is well designed and has many of the same features as the web version, including predefined watch lists, streaming news, an economic calendar, client sentiment data, and top movers.

There’s a good number of integrated videos that feature webinar-style educational material, with several videos lasting more than an hour.

Although the watch list doesn’t sync with the web version and there are roughly half as many indicators, it’s still great to use xStation 5 charts.

Research

Compared to other brokers, XTB excels when it comes to research tools, thanks to its advanced analysis from both its third-party providers and in-house staff. Autochartist and Trading Central aren’t available. However, XTB compensates for that by providing exclusive strategies that are included in its Premium Research service.

XTB has a stock screener that can filter relevant fields to sort through 1700+ tradable cash equities and single-stock CFDs. For scanning symbols to trade, this screener is definitely a handy research tool. Trading signals, as well as price analyses from Barclays, Citigroup, Thomson Reuters, and others, can be found in the news panel.

XTB provides articles written by its staff, as well as YouTube videos, in addition to streaming headlines from top-tier news sources, market sentiment, an economic calendar, and others. On the other hand, when it comes to XTB’s English YouTube videos, it does lack a range of daily market updates, but XTB’s other supported languages, like German, Polish, and Italian, provide more frequent daily video updates.

Plus, in the section of news headlines, It’s difficult to distinguish between articles that are written by their in-house staff and pieces written by other third-party providers.

Education

You’ll most probably be satisfied by XTB’s educational content, all thanks to its extensive videos and written content. In the “Learn To Trade” section, there is a wide variety of educational material that can be browsed by experience level or topic, as well as premium educational material.

You’ll find 10+ lessons about forex and CFD. Similarly, the intermediate course consists of approximately 10 lectures and many platform tutorials. Each course includes both videos and articles for beginners. The content follows the industry standard of offering basic educational content on the forex and CFD markets.

There are also plenty of articles on more general topics like the macroeconomic indicators, fundamental and technical analysis, and risk management.

On YouTube, XTB has 5 videos in its Trading Academy playlist, as well as 17 videos in its Masterclass series, one of which is 11 hours long, impressive! You’ll find many of these videos available on the xStation 5 web platform as well as the mobile app, but in the Premium section.

Novice traders will find some useful material on XTB, but becoming a seasoned trader purely through XTB's educational material may be unattainable. However, to be fair, the material covers all of the important topics that a newcomer should know.

Overall Trading Experience

XTB has xStation 5, which is a streamlined trading platform that is accessible via any browser, including Chrome, Safari, Firefox, and Internet Explorer. The user interface is standard, with a straightforwardness that adds to its attractiveness. Although it isn't the most feature-packed platform, its simplicity makes it more appealing and appears more functional than it is.

This is XTB’s main offering which is fully integrated across desktop and mobile platforms. The mobile version of xStation 5 has most of the same features as the desktop version, with the exception of the ability to set price alerts, which seems like an odd mistake.

Traders can use the iPhone or Android apps to access XTB's trading instruments, account details, order types, and charting. On the smartphone application, there is also a live news feed.

Trading, customizing charts, and building watchlists are all easy and intuitive on XTB. Traders are notified directly on the platform or through the mobile app, which is a feature that every trader needs.

However, there were certain drawbacks. It was not possible to create custom indicators. Investors who are already comfortable with the third-party application can use XTB's MetaTrader4 platform, which includes this and other features.

XTB does not provide social trading/copy trading, a free VPS service, or a money manager account.

Accepted and Unaccepted Countries

XTB accepts traders from most parts of the world.

On the other hand, they don’t accept several countries, including United States, Australia, India, Syria, Pakistan, Iraq, Iran, Indonesia, Albania New Zealand, Belize, Belgium, Hong Kong, Mauritius, Japan, South Korea, Venezuela, Turkey, Bosnia and Herzegovina, Cuba, Ethiopia, Uganda, Yemen, Laos, North Korea, Afghanistan, Guyana, the Republic of Zimbabwe, Republic of the Congo, Vanuatu, Mozambique, Libya, Panama, Macao, Kenya, Palestine, and Singapore, Bangladesh,

Is Your Money Safe on XTB?

XTB can be described as a low-risk broker thanks to the fact that XTB is a publicly traded broker that’s regulated by tier-1, tier-2, and tier-3 regulators. Below is a list of XTB’s regulators:

- XTB U.K. is regulated by the FCA

- XTB Europe is regulated by CySEC

- XTB International is regulated by the IFSC

- X-Trade Brokers DM SA is authorized by the KPWiG

- XTB Spain is regulated by the CNMV

Although there are no guaranteed stop loss orders, XTB provides negative balance protection. Passwords on XTB must contain upper/lower case letters, characters, and digits. XTB doesn't offer two-factor authentication, but it does offer biometric authentication for the mobile app.

Customer Support

A broker that does not prioritize serving the demands of its clients in a satisfactory manner may be condemned to failure in today's world. And XTB seems to understand this pretty well.

prospective clients and clients can contact XTB via email, while phone assistance is available 24/5 (users outside Europe can reach the customer service 24/7), and a live chat option is also available on XTB. Moreover, you’ll be assigned an account manager who’ll help you with account-related issues.

While the live chat option is not the most reliable (since requests for live chat are redirected to an email form in most cases), the option of phone support is great if you want to talk directly to a human.

XTB's customer service is offered in a variety of languages, making it more appealing to a wider range of clients. Some of these languages are Turkish, Italian, Arabic, French, Spanish, English, Chinese, and more.

Account opening phone number: +357 257 25356

24/5 support phone number: +48 222 739 976

The Bottom Line

We can say that XTB is an above-average CFD broker. It’s regulated by a tier-1 authority and is listed on the Warsaw Stock Exchange, plus it has a low forex CFD fees and fast deposit and withdrawal process. In general, a lot of Europe-based traders will find it a pleasure trading on such a broker that has up to a 100,000 EUR monthly trade volume.

But they should be aware of its high stock CFD and limited range of products. XTB is best for traders who prefer CFD or forex trading who wish to enjoy a seamless trading experience.